A sporting chance

When I try to explain Australian values to those in the UK, one of the main things that hits home is that in Victoria, there are two public holidays a year for sporting events.

It would be incomprehensible for Britain to declare a holiday for the Grand National or the Friday before the FA Cup Final.

I love sport – both playing and watching it.

I also love a good crack at a Fantasy Sports competition. For those unfamiliar, you are typically given an imaginary budget of $100m, a list of players in a sports league, each with varying values and the chance to build a squad.

How your players perform over the season scores you points, 1 point for a successful pass, 8 points for a goal etc. etc.

In early 2017, before we’d moved to Australia, I thought it would be fun to join the families AFL Supercoach fantasy league. I’d watched maybe half a dozen games of AFL in my life. It seemed fun and I thought it would be good training for coming to live in Australia permanently.

My father-in-law and brothers-in-law happily accepted this patsy to the league.

I started with little to go on. I found out the Western Bulldogs had won the Grand Final the year before so a couple of their players went in. I’d heard of Buddy Franklin at the Swans and stuck him in my forward line.

This ate up a chunk of my budget being more expensive players.

I started looking at the Stats. I found a few players who’d done well previously but had a poor 2016, so were a bit cheaper. A few of those guys went in.

Another few players were injured in 2016 so cheaper this year. I took those onboard.

I would watch the one televised match in the UK on the Saturday morning and made my trades based on just the stats and official team announcements rather than what I’d seen in games.

By season end, I’d ended up ranked 1028 in the overall competition out of 100,000+ teams and won the family league. I think I was in the top ten of non-Australian based players.

Dissecting the season over the family dinner table a few things became apparent. The family would never pick Collingwood players as they were Carlton fans. The players they’d held in their teams in previous years, that had let them down through injury or form were never picked again.

Emotion, such an important part of sports, was clearing to the detriment of being successful in a statistics based game.

Since moving over permanently, my year end rankings have fallen steadily

2017: 1,028

2018: 2,979

2019: 8,273

2020: 1,017 (an anomaly I think – lots of player matches cancelled due to covid, meaning players got zero scores, which I missed through luck rather than skill)

2021: 19,962

So where have I gone wrong?

This to me is a classic case of allowing information and bias to affect my judgements.

In the relative vacuum of the UK, I had little to go on but numbers. No news reports, speculation or opinion to bias my views.

Now an Australian resident, I watch a few games a week and have my favoured teams and players. My fantasy selection was a mess and my biases are now very hard to shake.

I’m not going to select a Collingwood player unless I really must (currently this isn’t a bad thing.)

Investing runs along a similar theme.

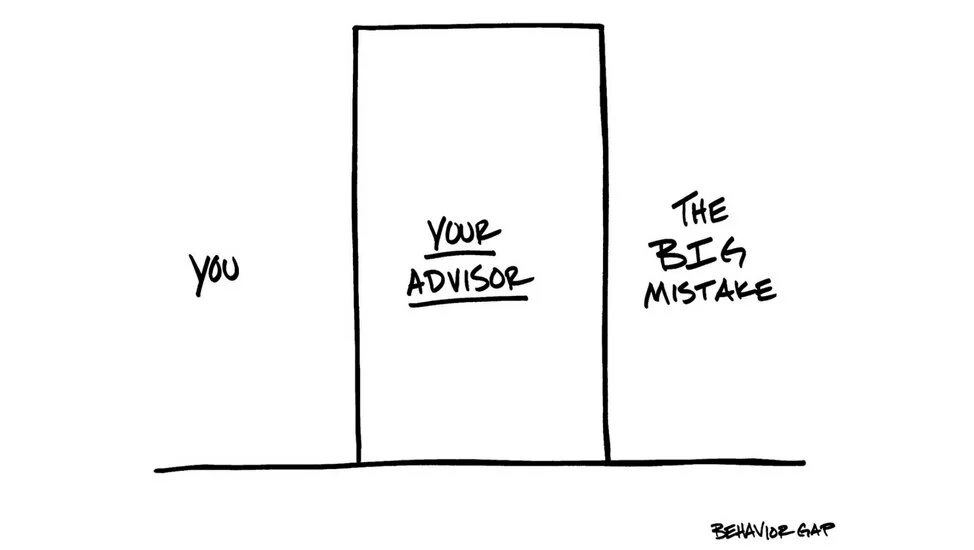

If you pick your investments based on the weekend money newspaper pullouts or the business news, you’ll end up going crazy and probably losing a lot of money.

People who’ve been burnt but a bad investment may never invest again for fear of getting burnt again.

But if we look purely at the data, Global stocks go up over 60% of their trading days. We will always end up with more, the longer we hold.

The market can be beaten in the short term by luck but can’t be beaten consistently over the long term.

We buy a diversified selection of the world’s companies, offset this with enough bonds or cash to help us sleep and get on with our lives.

When you’re next at a barbecue (remember those?) and someone starts bragging about their investment or fund manager, they’re likely confusing skill with luck. They’ll just keep quiet on the other investments that didn’t go as well.

A well-informed investor will shut out the noise and stick to the facts and a consistent investing process.

To end with one of my favourite quotes from W. Edwards Deming:

'Without data, you’re just another person with an opinion',

Time

The past couple of years of living with the spectre of Covid have given plenty of us time to reflect on how we spend our time and what values we have in our work and social lives.

Economically, we’re told many states have lower unemployment than pre-pandemic and whilst a significant government debt from support payments has been built up, the underlying desire to start living again meant NSW Treasurer, Dominic Perrottet called us to look forward to a “bright Summer.”

The impact on working life for many from a major event such as Covid might be the most significant any of us has seen or will see in our lifetimes.

Many organizations will now be questioning just how many levels of management are needed when individuals in their teams, when sent to work from home, largely got on with it with little fuss.

Is the typical working model of going to a workspace to be overseen from 9-5 by a manager to ensure you keep working, only take your 1 hour for lunch and two tea breaks now defunct?

I’d always hated the 9-5 type roles. Not that I was either an early starter or a night owl by preference but the logistics of it never made sense.

Instead of a steady flow of people on public transport and roads across the day, we get bottle necks of rush hours with high traffic and expensive peak rate transport costs.

When I was working in London, I’d end up having to take earlier and earlier trains in the morning just to get a seat.

It doesn’t even help those who services these workers – cafes and food providers have to try and staff for 7-9 am breakfast and 12-2 lunch period with idle time either side.

Supermarkets get rammed on weekends as people’s work life must be completed between Monday and Friday.

Now workers have had more experience of being able to work as fits their life, most will be resistant to return to structured hours permanently, although I expect most will want to get back in person time with clients and co-workers.

Assuming a balance between home and office is agreed, many workers are considering retiring later than they ever planned according to this article

When I ask clients about the ‘why?’ for needing financial planning most will initially go down a route of thinking of ‘I want to pay less tax’ or ‘I want enough money to retire early.’

But when you press them again on exactly why that is important, a common answer is that people want more time.

One of the great drivers for me to set up my own business, was to take back control of my time.

I still work the same hours in a week as before but in a different order. Sometimes I work in the evenings, sometimes I start early in the mornings. Occasionally, I tidy up a few things while our son naps on a Sunday.

Time has no monetary value, it has no currency. We all want more Time but we don’t know how much of it we have left.

Whilst I love my job, I don’t want to spend so much time doing it that I can’t spend time with family and friends.

So, what value to you is time? Would you work for a lower salary to have an extra day’s leave each week?

The outcome of good financial planning isn’t how much money you have on your last day on earth.

It’s about using the money earned from your hard work, to give you the greatest return on your finite time.

30 years of life

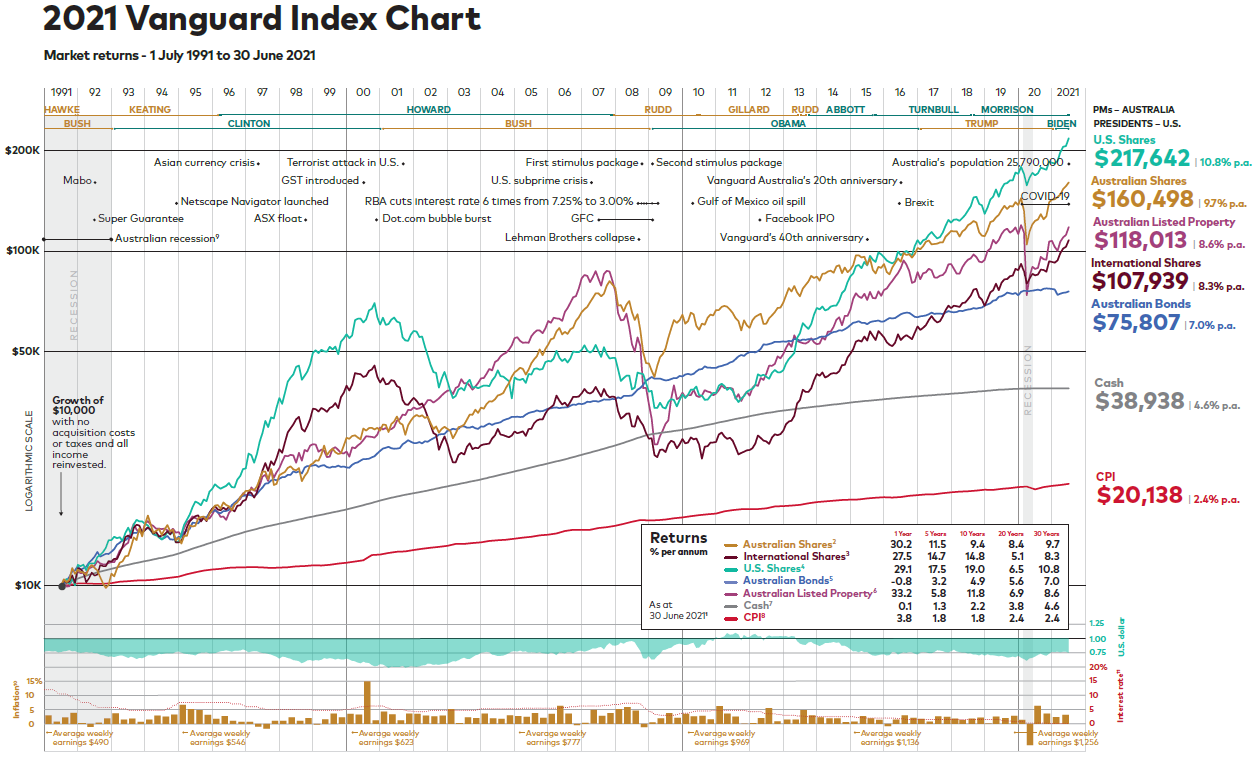

Vanguard have recently updated one of my most used utilities, the 30 year index chart.

You can see a larger version of the chart by clicking the image above or HERE

The chart shows the return of a $10,000 investment over 30 years invested in different asset classes (nb: it doesn't take off platform or tax costs) while highlighting on this journey some of the key events along the way, the different leaderships both here and in the US as well as interest rates and the value of the dollar.

A lot of info in one picture - I have an A1 version on my wall in the office.

Thankfully Vanguard have also provided some additional explanation in an easy to read Brochure and also a short Video

A few trends and points of note from me:

Inflation is catching up with Cash - fast. Inflation (CPI) of 3.8% last year vs. Cash returns of 0.1% and also 1.8% vs. 103% over 5 years shows that cash is losing it's value. Unless you're spending your time hopping from bonus rate to bonus rate in cash accounts, you're losing spending power quickly.

Global diversification of shares beats everything. I've spoken before about the remarkable run in the last 10 years of US stocks - Apple, Google and all - but 2000-2010 is known as the lost decade for the US Markets. From a high before the tech crash, the US market spent ten years creeping down with a massive drop at the end from the GFC. It would have been incredibly tempting for a holder of US stocks to dump their portfolio along the way to seek higher returns. But the patient investor has been rewarded handsomely.

The markets don't care about the news. Other than major economic events, like a Covid shutdown, there is virtually no correlation to global stock markets. News channels try to convince us otherwise as scare stories get more clicks than good news stories.

Scams and Cons

This week I had an email from the Metric Wealth HR Department. Apparently, I had $376 of underpayment due to me from the last tax year and a statement of this was attached to check.

This was very intriguing, especially as I don’t have an HR department.

Now as scams go, this one was reasonably obvious, but had it come through to me while working in a bigger organisation, it was glossy enough to attract a casual click.

Who knows what was in that attachment but its now off into the trash.

Pandemic conditions, especially with the multitude of cash payments from welfare and governments are seeing an increasing number of sophisticated scams popping up.

Last year, Australian’s lost $851 million dollars to scammers – a record amount. (Although still not a patch on Australia’s not so proud gambling losses - $24 billion. An unwanted world record.)

Those with Supers and investments (which is most of you reading this) are prime targets.

In a financial planner discussion forum (yes, such places exist for us to discuss exciting trends like Division 293 taxation notices) another planner shared the below, that his client had been sent. Using imagery from a genuine brochure by reputable fund manager Vanguard, they’d created a fake fixed interest account paying over 7% per annum. Who wouldn’t want that in a low interest world?

No matter how high our email security settings, we will all get a few slip through.

If you get something that’s borderline and you’re not sure, then call me – we’ll quickly do a screen share and look at it together (please don’t forward it!)

Financial advisers have a highly tuned scam detection radar, we’re naturally cautious people as we’ve had many dubious pitches to us over the years I was once pitched a fund that invested in a scheme run by Bernie Madoff. I sidestepped that although the returns looked amazing.

If it seems too good to be true – it probably is.

Metric in the media

I was lucky enough to be featured this week in the Sydney Morning Herald, talking about Super and investment risk. You can read the full article HERE

Obviously my full commented made the cutting floor of the editors office (which is fair enough, it’s not an article about me) so I thought I’d share with you the questions I was asked by Journalist, Simon Webster, and the answers I gave in full in this weeks update.

How important is it to choose an investment option within super that's right for you, rather than just pick the default and set and forget?

Settling for a default option can cost a saver thousands of dollars over the long term, either by not producing enough growth to build a sufficient fund by retirement, or by accepting a higher cost investment that can eat into your returns.

What factors do you need to consider when choosing an investment option? Eg goals. Risk profile.

Try to pick your investment by its contents, not what it is called. A fund marketed as ‘Balanced’ could have half their money in the stock markets or they could have over 90%. Simply comparing them by name and return is not comparing apples with apples. Generally, the more exposed to global stock markets a fund is, the greater the return will be over the long term – but be aware it will be a bumpier ride than more cautious options like cash or bonds.

If you are just entering retirement, it doesn’t mean you should switch straight down to a ‘Cautious’ investment option. The average life expectancy at retirement is over 20 years and rising. You still need growth to make your money last as long as possible, and with the current low returns on cash and bonds, a cautious portfolio will likely be depleted very quickly and not keep pace with the inflation you’ll see in your day-to-day costs in retirement.

What is a risk profile and how do you know what yours is?

When we talk about risk in risk profiling, most advisers are trying to see how you would react to volatility in your Super portfolio. Whilst there are several online profile tools and questionnaires, you might reflect on your own actions last year when the market fell significantly. How did it make you feel? How regularly did you check your Super? With hindsight, would you have acted differently?

In a volatile market, how important is it to think long term rather than overreact - e.g. by changing your investment option to cash - when the market falls?

On average, the global stock market rises every 3 out of 4 years. Gaining a meaningful return is just a numbers game - the upsides will outnumber the bad over the long term, but we have no idea when the temporary declines will be.

Switching to cash in a downturn means you need to guess correctly twice – once on the way out and again on the way in. You’ll never get it right, so don’t try!

How often should you review your investment option and what factors might make you change to a different option?

The more often you change your investment option, the more likely you are to receive a poor lifetime return.

Review all your finances, not just Super, annually but a review doesn’t mean you need to make a change.

It is better to start with a fund that has a lower stock market exposure and each year increase that exposure, than to go the other way, start high, panic and sell.

Taking professional advice to ensure you make the correct decisions when markets are volatile can give you the confidence to hold a fund with higher exposure to the stock markets.

Upcoming Changes to Income Protection Policies

Insurance companies make a fair amount of money on Life insurance. This is because most people will hold life cover until they retire or have cleared their mortgage and then cancel without ever claiming. Longer life expectancies have also factored into this.

However, one type of policy where claims have increased significantly in the past 20 years is income protection. As medical understanding of illnesses regarding mental health has increased claims in this area and the generous wordings of older policies has meant that payouts have lasted longer.

In short, income policies in their current format are unsustainable and the regulator has worked with life companies on the rules surrounding them to ensure there is not a complete collapse of the structure in the future.

New government regulations have been introduced that will reduce the benefits available on new income protection policies written after 1 October 2021, mandated by the Australian Prudential Regulation Authority (APRA).

Those who hold cover via a group insurance scheme – such as bundled insurance in an industry fund or company scheme – will be affected by these changes.

If you currently have a standalone comprehensive policy, or can get one in place by 1 October 2021, you will maintain your existing higher benefits.

From October 2021, however, these extra benefits will not be available on new polices, due to the changes

The changes include:

Income replacement ratios to be reduced to 70%, from 75% currently.

Currently if you earn $100,000 per annum, you can obtain income replacement up to $75,000 per annum. From October the maximum will be $70,000.

Income to be calculated on last 12 months income only, compared to some current policies offering highest 12 months income in the last 2 or 3 years.

When you make a claim on income protection, the insurance company – depending on their own policy rules – will normally take your best 12 consecutive months of earnings over a 2 or 3 year period, when ensuring you can claim the full benefit of your cover.

So, for the client below who averages $100k over three years and makes a claim – they can use their best 12 months earnings from the 2020 year to verify their claim.

Under new rules, the claims will only look back over 12 months – if this were a bad year, (hello lockdowns) and they only earnt $50,000 – the most they could claim is $37,500 per year.

This is a massive kick in the teeth for business owners, or those with bonuses, with variable income and also those returning to work after career breaks or for child care.

Long benefit periods, such as to age 65, to be managed to maintain a motivation to return to work. This may include changing from “Own Occupation” to “Any Occupation” definition after 2 years on claim.

After 5 years, your benefit may be cut if it is determined you can return to the workforce in ‘Any’ suitable role you could be trained for, even if it wasn’t your job pre-injury.

Furthermore, life companies can now reassess your occupation every 5 years. If you’ve changed jobs from being an accountant to being a lion tamer – expect a hefty premium increase.

Action to take

Income Protection is the most valuable of all insurance covers – the loss of a salary can happen quickly and as many as one in four of us will have to take an extended period off work before retirement.

These change will affect existing group and industry super policies, so it is more vital than ever to have your own income protection polices and not rely on your Superfund.

These changes have unsurprisingly not been heavily publicised by the life companies as you can imagine!

Email hello@metricwealth.com or call us on 1300 50 20 30 for a complimentary review of your insurance cover.

Inflation: Should I be worried?

Do you ever get the feeling the financial press were slightly disappointed the temporary decline in the global stock markets in 2020 has been erased and surpassed? A growing stock market isn’t really newsworthy after all.

Instead, in the last few months we’ve seen a new set of warning signals being flagged in the press citing the prospect of rising inflation as the next doomsday scenario on the horizon.

For the economy, inflation is like salt to your dinner. A little can enhance the flavour, accidently pour too much and the dinners in the bin. So, we need some inflation to keep things ticking along.

However, inflation is a silent killer of savings for the average Australian.

The trap of cash and bond heavy portfolios

Take the classic example of a postage stamp:

So if a client walks in my door needing a $50k a year income from their investments of $1m for the next 20 years, why not just leave it as cash, drop it into a bank account, set up a regular withdrawal and send them on their way. $1,000,000 divided by 20 is $50,000 a year?

Unfortunately, that’s not how it works. Because if inflation averaged 3% (the long-term average), they would need nearly $1,383,824 over those 20 years and an annual income of over $90k in year 20.

Inflation, even in it’s mildest form kills the investment plans of those who save in cash and those who are incorrectly guided to ‘Cautious’ Portfolios in retirement, which are highly invested in bonds.

At Metric Wealth, we don’t use terms like ‘Cautious’ and ‘Balanced’ when describing our portfolios.

Cash and bonds are some of the most dangerous assets to predominantly hold when it comes to maintaining our long-term spending power.

Inflation hasn’t really been on our radar for a while (except those looking to enter the housing market) but it’s almost always there.

Why might it be increasing soon? We have many economies around the world that have been propped up with free cash from Governments, consumer spending levels on luxuries (holidays, eating out etc) is down over the last year, whilst savings rates have increased.

As the world opens up, this can see a rapid rise in spending. Higher demand can increase prices when you’ve more buyers for limited resources (as supply chains start to catch up.)

Prices rise, employees push for higher wages and the circle continues.

How long an inflation trend lasts for, when it starts and when it stops, and where prices normalise after is completely unknown.

Are changes to portfolios needed?

An inexperienced investor (or a poorly advised one) will be reading the headlines and making changes to their portfolio now – switching into gold and commodities, which tend to briefly do better in high inflation periods – and expensive fund managers are already starting to make their media appearances talking about how they will ‘rotate their portfolios’ to justify their fees.

Let’s be very clear – jumping in and out of gold or any other inflation hedge is more likely to make you poorer than richer. It’s complete luck in market timing if you buy into or out of these assets at the right time.

Returning to the stamp table and we’ll add in the Governments measure of inflation – a basket of goods and services - and also the Australian All Ordinaries Stock Market (the broadest and longest running Australian Stock market.)

Add in a steady stream of dividend income on top and the stock market knocks inflation even further out of the park.

A portfolio held mostly in the great companies of the world via the stockmarket, combined with your own calm behaviour will beat inflation in the long term every single time.

Sitting in a default balanced or lifestyle Super fund (or worse, in cash) for most of your life means the silent dragon of inflation can smash your chances of a dignified retirement.

If you’ve never reviewed your Super, feel free to send an email to hello@metricwealth.com and we’ll be in touch,

End of tax year planning

11th June 2021

To those of you in Melbourne, welcome to the first day of freedom again. Hopefully, this will be the last time you have to go through a lockdown.

I’ve just booked in for my vaccination in a couple of weeks – if you’ve over 40 nationwide, you can now book an appointment. New appointments seem to appear first thing, I checked a few times last night and there was nothing but at 7am this morning I logged in and there was plenty.

The end of financial year is approaching, so I thought it would be useful with this fortnights letter to summarise some of the main planning strategies for us to consider heading into 2021/22 TY.

Pre-retirees

Maximise tax deductable Super contributions.

If your employer contributions and your own salary sacrifice contributions total less than $25,000, you can make additional contributions from cash savings and claim a reduction on your tax.

Contact me if you’d like to do this and I’ll help arrange.

Check employer contributions for next year

Next year the Super Guarantee rises from 9.5% to 10%. The amount you can put in before tax rises from $25,000 to $27,500.

If you’re fortunate enough to have the maximum paid by your employer (or if you own your company) you should check that you will be given the new higher contribution next year.

Pay for any deductable expenses now

If there’s an education course for your job that you’d like to do, equipment you’ll need for your business etc. you may wish to pay for these now, to claim a deduction on this years tax.

Check what is deductable in relation to your own role with an accountant – but don’t use it as an excuse to upgrade your iPhone if you don’t need it! Buying something you don’t need just to claim a deduction only fills the pockets of Harvey Norman – and they’ve had enough tax payer cash.

Tax harvest losses

Shares that you own outside super, that are running at a loss to purchase price can be sold, with the loss carried forward against future gains. Take care though – if you sell a share and then repurchase it in a short time frame, then the ATO may penalise you.

You can buy a similar share with the proceeds however – ie. Sell Commbank to buy Westpac etc. but generally I would aim for something more diversified than a single company.

Post-retirees

Extension of lower minimum withdrawals

Surprisingly, the Government has extended its reduction in the minimum required annual withdrawal from any tax free pension accounts.

As I have spoken to many of you about this year, best practice is to take the minimum from your pension where possible and top up with other funds if required. If you have other funds to support you for the whole year, we can also consider pushing the minimum payment until the end of the tax year – leaving your savings in a tax free wrapper for as long as possible.

Abolishment of the work test

The abolishment of the work test is a big win for retirees. Those of you retired and under 75, can now continue to make contributions to your Supers, without having to pass an activity test, showing you’d worked 40 hours within a 30 day period.

This means that if the pension payment you take (or are mandated to take) is more than you need for the year, it can be contributed back into your Supers.

As ever, take advice on your own circumstances before acting on any of the above.

Cryptocurrency: A bite of the Bitcoin

The discussion around cryptocurrency has come up quite often for me in the last year or so. Most of it is out of curiosity from friends and clients, rather than a desire to partake in the buying and selling of cryptocurrency.

Let us firstly think about what these currencies are intended to be – a universally accepted credit. Based on this as consumers, it seems like a great idea.

As a child, we used to regularly hop the channel to France for our holidays and my Father, who worked in a bank would be watching the exchange desk like a hawk for 6 months prior deciding when to purchase his Francs. He’d be beside himself on the odd occasion he’d get over 10 Francs to the Pound. Even as a child, I would be given my pocket money in French currency for a couple of weeks and given the calculation to work out how much something would of cost in the UK.

A good exchange rate might mean our Bikes be upgraded in the wonderland of sports supermarché Decathlon – then only available in France but now found near the airport in Sydney and across Australia.

A single stable currency works well for consumers and business trading overseas, the Euro being successful across Europe, once the initial uncertainty over it’s value settled (I remember the price of a pint of Guinness in Dublin nearly doubling pre and post change.)

However, the problem with any currency is that as well as owning it, you need to find someone willing to receive it. So, an electronic currency is ‘easy’ enough to create but needs mass participation and adoption to become usable and accepted. It cannot be easily forged, stolen, or creatable – as such there is a nearly finite supply, which creates significant volatility compared to domestic currency, which can be created (and taken away) by governments as monetary policy dictates. There is no government to bitcoin, or others, to control, thus it’s value can be moved rapidly by headlines or sentiment.

Therefore, we see such fast movements in Bitcoin. I use Bitcoin as a bit of a catch all for Crypto in the same way my parents called every computer game ‘Space Invaders.’ It has been one of the longest running and most successful cryptocurrency launches but there are hundreds of alternative currencies being created all the time. If there are two people in the world willing to pay in and be paid by a means, it’s a currency. Hey, even cheese is still a currency in parts of Italy.

I took a picture of the above sign in Sydney in late March and commented on it’s lack of warnings. At the time, Bitcoin was flying. Tesla had bought a significant amount of the coin, which acted as a sign to many that universal acceptance of the currency into the mainstream.

Fast forward to now and Tesla have back peddled, stating they will no longer accept payment in Bitcoin. Bitcoin has fallen over 30% since I took that photo, continuing a pattern of rises and falls since its creation.

Does crypto belong in a well-diversified lifetime portfolio? No.

This is the same view I hold of any currency other than your own countries, within your portfolio. It doesn’t fit the two fundamentals of a long term investment, in that it should provide you with potential for growth through two means – it’s value and it’s income. With any currency, you are only betting on its value to rise, it doesn’t provide you with income via a dividend, rental income or interest payments.

Do I think cryptocurrencies have a future? Yes.

I am sure that at some point there will be a dominant player in the market of crypto but – and this is a big but – it may not even have been invented yet. Bitcoin is certainly the frontrunner for the crown, but my feeling is that a big player like Google, Microsoft etc. could come to town and clean up. Facebook hinted again they would be coming to town. They have size, profit and most importantly, consumer trust (to an extent) on their side.

For now, it is a gamble. Adverts like the one for Luno have been gradually pulled by advertising watchdogs and hopefully we will see a greater regulation of the market.

However, signs this week from the Government are that they’re not going to stand in the way of similar trading companies from abroad coming to sell into Australia. Senator Jane Hume saying this week “We have to back Australians to be sensible enough to judge for themselves, where and whether to put their hard earned money into high risk assets.”

So, whilst Financial Advice firms are subjected to higher and higher education and compliance standards (and costs,) our clients will continue to see unregulated advice via billboards and social media.

Continue to shut out the noise!

Have a lovely weekend and for those of you in Melbourne, I hope this latest set back passes smoothly,

Australian Federal Budget 2021 thoughts

Federal Budget’s tend to follow a bit of a pattern. The first, after a party takes or retains power implements the policy of which they were elected. It tends to be an unpopular budget, where promises might not be kept or changes to tax, support etc that are needed, can be made without fear of being ousted.

Budgets in the final year tend to be marketed more as a giveaway, bolstering confidence among voters and increasing the Governments public relations. This budget certainly followed this line with the can kicked down the road in terms of how debt created in the last year, will be tackled.

Some of the major spending points – increase spending in the Aged Care sector and raises to several areas of Women’s health are arguably patch ups of parts of society that should never have been allowed to get to the position they are currently in.

The position of the overall economy is certainly stronger than the Governments own predictions from last year. Australia’s response to the virus has certainly contributed to this with many parts of the economy closed for much shorter periods than their international counterparts but the stuttering vaccination roll out will continue to impact areas reliant on tourism.

The outlook for investments and savings leads us to continue to expect very low interest rates for many years. The Government will continue to encourage spending over saving and low interest rates helps keep their own debt repayments low.

In the long run of 20-30 years, the main ways a Government can tackle a deficit is to a) increase their tax take, b) reduce their expenditure and c) rely on inflation to reduce the Real value of the debt. Inflation in the economy certainly won’t be discouraged (a rise in prices means the Government takes home more tax among other factor) so it continues to be the main financial dragon we must fight as individuals.

There are a few points in the budget that may change our own or families strategies going forward:

Abolishment of the Work Test for those 67-74.

Currently, people aged 67 to 74 years can only make voluntary contributions to their super if they’ve worked at least 40 hours over 30 consecutive days in the financial year.

The removal of this test will allow people in this age bracket to add further to their Supers or recontribute Pension payments that aren’t needed.

Super pensions are designed to run out due to their increasing minimum withdrawals. The Government don’t want you keeping money in a tax free environment! The change to this rule will allow people to keep replenishing their Supers until their 75th birthdays if cashflow allows.

Extending access to Downsizer allowance

Currently, those aged 65+ can make a $300,000 one off contribution to their Supers from the sale of their family home ($600k for a couple with a jointly owned home.) This has now been brought forward to those aged 60+. A great option for those selling in a hot Sydney or Melbourne market and moving to a lower priced area of the country. Despite it’s name, many downsizing contributions come from people moving to a bigger property!

Using other allowance available as well, my rough calculations estimate a couple could now get up to $1,285,000 into their Supers in the year of a main home sale.

Extensions to the First Home Super Saver

The First Home Super Saver scheme allows those saving for a first home to make extra contributions to their Super, which can then be withdrawn at a later date when buying a first home. This saves them tax (as contributions can be put in as a salary sacrifice or deductible amount) and earns a predetermined return of over 3% (it is not determined by the returns of the Super.) Important to note, you cannot withdrawn contributions from your employer.

Up to $30k can be withdrawn this way currently and this has now been extended. I used the scheme myself and even as someone who should know what’s going on, found it unnecessarily complicated and hard to fathom.

Labor had said they would abolish this scheme if they came into power, so I’d always been a little hesitant recommending it, in case the Liberal party also shelved it. However, they’ve doubled down and increased the maximum withdrawal to $50k, so I think it’ now represents the best first step in saving for a first home.

But it’s still complicated! If you have children, friends or relatives who you think might need to understand this, I’m happy to have a chat and put it into plain English.

Investment Tips: Another Dimensional

Last week saw the 40th anniversary of Dimensional Fund Managers being founded.

Dimensional may not be a manager you have come across previously – they don’t advertise in the mainstream media and their funds are generally only available through Adviser led investments.

Yet, they are the 8th biggest fund manager in the world. Currently I use Dimensional for the Global Fixed Interest and Global Smaller Companies sections of the Metric Wealth Portfolios.

If most investment groups launched in the 80s were run by Wall Street stock pickers dressed like Miami Vice extras, Dimensional were the other end of the spectrum being founded by Nobel Prize winning economists Ken French and Eugene Fama.

One of the other founders, David Booth, wrote a piece this week on the lessons he’s learned over the 40 years, from which I’ve lifted a couple of sections which I think are relevant to all of us and how I choose to advise on money.

1. Gambling is not investing, and investing is not gambling

Gambling is a short-term bet. If you treat the market like a casino, and you’re picking stocks or timing the market, you need to be right twice — in an aim to buy low and sell high. Eugene Fama showed that it’s unlikely for any individual to be able to pick the right stock at the right time — especially more than once. Investing, on the other hand, is long term. While all investments have risk, there are things you can do as a long-term investor to manage those risks and be prepared. As my dear friend and Nobel laureate Merton Miller said, “Diversification is your buddy.” Investing, to me, is buying a little bit of almost every company and holding them for a long time. The only bet you’re making is on human ingenuity to find productive solutions to the world’s problems.

2. Embrace uncertainty

Over the past 100 years, the US stock market, as measured by the S&P 500, has returned a little over 10% on average per year but hardly ever close to 10% in any given year. The same is true of dozens of other markets around the world that have delivered strong long-term average returns. Stock market behaviour is uncertain, just like most things in our lives. None of us can make uncertainty disappear but dealing thoughtfully with uncertainty can make a huge difference in our investment returns, and even more importantly, our quality of life.

3. Tune out the noise

If an investment sounds too good to be true, it probably is. When people ask me if I’m investing in the latest shiny investment idea, I tell them, “If I don’t understand something, I don’t invest in it.” That’s because I’ve seen a lot of fads come and go.

TV pundits handing out stock tips? Friends letting friends in on their next big investment? I see these more as entertainment than information. Stress is induced when people think that they can time markets or find the next winning stock, or that they can hire people who can. There is no compelling evidence that professional stock pickers can consistently beat the markets. Even after one outperforms, it’s difficult to determine whether a manager was skilful or lucky.

The good news is you can still do well without having to find what markets might have missed. While markets are unpredictable and may even seem chaotic at times, they have an underlying order. Buyers and sellers come together and trade, which is the activity that sets market prices. Unless each side agrees to a price, they don’t trade. New information and expectations about returns are quickly incorporated. Consistently finding big winners is difficult, but everybody can have access to the expected returns that a diversified, low-cost portfolio can generate.

4. Have a philosophy you can stick with

It can be difficult to stay the investment course during periods of extreme market volatility. At the end of March 2020, the S&P 500 was down nearly 20% for the year. Record amounts of money exited from equity mutual funds and went into money market accounts. Those investors who stayed out of the equity market missed out on the subsequent 56% gain in the S&P 500 over the next 12 months. We will all remember 2020 for the rest of our lives. It serves as an example of how important it is to maintain discipline and stick to your plan.

By learning to embrace uncertainty, you can also focus more on controlling what you can control. You can make an impact on how much you earn, how much you spend, how much you save, and how much risk you take. This is where a professional you trust can really help. Discipline applied over a lifetime can have a powerful impact.

My Best Investment

One of the most common questions I get asked by people, when they find out I’m a Financial Planner, is ‘What’s the best investment you’ve made?’

I think there’s an immediate thought from some that being in this business means I jumped on Apple shares in the 90’s.

Whilst I’ve benefited like many from rising stockmarkets and property values, I’m pretty certain on a dollar-for-dollar basis, the answer lies on a bench top in my kitchen.

Not my actual kitchen, unfortunately

When moving from the UK, there were several electrical gadgets which we decided had seen their best days, including our old Espresso machine.

Having been suitably impressed with our brother-in-laws flat whites we bought a Delonghi Magnifica coffee machine as a moving in present to ourselves, when occupying our first rental home in Sydney.

I’d never been a big coffee drinker until my mid 30s, having been raised on the English staple of milky white tea. Asking for a Flat White in most British café’s would see you met with a blank stare and finally an offer of an awful cappuccino.

However, with the abundance of baristas near the old Eluvia offices I would routinely buy coffee during the day and even on the way to work. An easy habit to fall into and my wife would do the same..

Fast forward four years and we are now predominately work from home. On the days we are working in town, we’ve tended to make our first coffees from home using the machine rather than buying on the way.

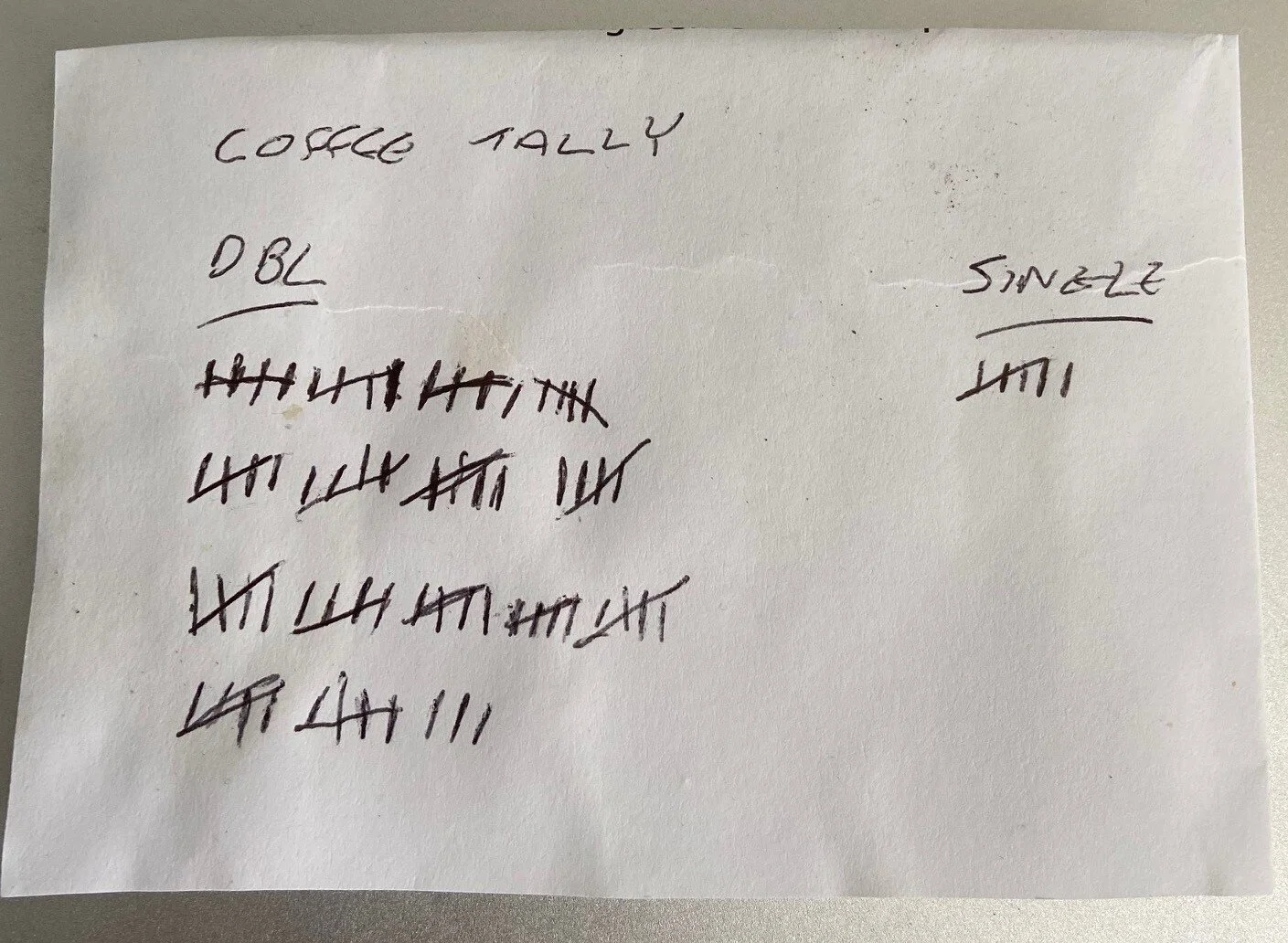

Curious, as to the relative saving this was making us compared to our old habits, when starting a new bag of beans last month, I kept a tally of usage.

A $50 bag of beans produced 78 ‘Double Shots’ and 6 ‘Single Shots.’

A total of 162 shots at 0.31c per shot.

Each coffee has about 150ml of milk. Our milk costs $4 for 2 Litres, so that’s 0.30c per cup.

Each double coffee therefore costs us 0.91c and each single coffee costs 0.61c.

Add a little electricity and water and we’ll call it 0.95c and 0.65c.

In total to produce all those coffees it’s cost us $137.50

Let’s compare that to $4.50 and $3.50 respectively in a café:

78 x $4.50 = $351

6 x $3.50 = $21

Total = $372

Overall a saving of $234.50 dollars per bag of coffee and we buy a bag on average every 2 months, so $1,407 per year.

The machine cost us about $700 to buy initially so it has more than paid for itself despite at the time it feeling like an awful lot of money to spend on one item.

If I could find a stock or investment property that effectively offered a 200% dividend each year I’d be pretty happy.

When making big purchases, it is sensible to apply this lens to assessing the value. Price is what you pay but Value is what you get.

Sensible investing can do a lot of the heavy lifting to fund your savings and future retirement needs but spending on quality over quantity probably has a greater impact.

And possibly, I just need to drink less coffee.

Covid Markets: One Year On

A busy few weeks here at Metric Wealth with a few new clients coming across and plenty of follow up work from my recent trips to clients in Brisbane and Melbourne.

Looking back on some of my first email musings 12 months ago - I wrote about the world being ‘on sale.’

As Nick Murray, one of the great teachers of Financial Planners says, "I don't know exactly how things will turn out all right, I just know that they will turn out all right."

However, optimism does not sell newspapers. Even the relatively sensible Sydney Morning Herald was using words like Bloodbath early in March last year.

Panicked investors who were advised to sell out of portfolios to "wait for things to settle" have potentially lost years of retirement income and independence if they did.

I think I have mentioned to some of you, that of the many clients I was looking after at my previous firm, whilst several rang to discuss what was going on, ultimately only one of them moved to cash. When I last spoke to that client before I left the firm, he was still waiting for the perfect moment to ‘go back in.’

The short term pain relief he’d felt from moving to cash (and subsequently realising he’d made a mistake) was paralysing his ability to make a corrective decision.

Many Australians did the same, a recent study estimated 20% of Australians moved their portfolios to more cautious options. The scary thing is that many of these people were advised to do so. Any Adviser that did so should probably look for another career, but many will have talked their way out of it by reinvesting in the last half of 2020 (with their poor clients unknowingly missing out on a large portion of the markets recovery.) The compounding effect of jumping in and out of investments, will lose many years of their ability to support you.

Sometimes ‘doing nothing’ is the right thing to do. Your wealth will build through a well diversified portfolio and you'll maintain this wealth through good behaviour, it's that simple. Never underestimate human ingenuity, and the market's ability to be forward-looking.

Right now, the dread we felt at the opening of each market day has been forgotten by most. This is unfortunate, as future corrections will happen again and maybe the recovery won’t be as rapid as this has been. The way you’ll get through it again is by exhibiting the same good financial behaviour.

The 27th March 2020 was the lowest point of the ASX300. I would suggest you all take a moment to log into your investments on Monday and set the returns chart to ‘Last 12 months.’ It’ll be a nice start to the week.

Investing: A Golden Dart

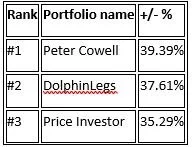

A story last week from the UK. One of the largest newspapers, The Daily Telegraph (different to the Murdoch publication in Australian) runs a regular ‘Fantasy Fund Manager’ competition in it’s finance section.

Entrants are given £100,000 of virtual money and 3 months to pick and trade funds and shares to build the biggest pot. The winner receives £10,000 and at the end of February the winners were announced:

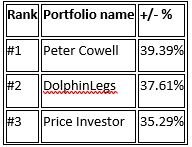

Leaderboard

The winner Peter Cowell, told his story to the Telegraph of research at 5am before the markets opened, while he tended to his baby daughter and an all or nothing punt on the shares of a cinema chain ahead of a Covid reopening announcement. Exciting stuff.

The Telegraph followed up their story be speaking to the anonymous investor ‘DolphinLegs’ who came second.

He had, unfortunately spent the last three months in hospital and had forgotten he’d even entered the competition.

Moreover, ‘DolphinLegs’ picked stocks at random, rather than carefully devising a five-stock strategy which would weather all market conditions and make a mockery of fund managers trading every day to outwit the competition.

“I spent literally no time assessing the merits of the listed stocks, using my preferred ‘golden dart’ technique. This involves the throwing of a virtual dart at a virtual dart board and bingo, five stocks had been selected within a matter of seconds,” they said.

Proof if ever were needed, that expensive fund managers know little more than throwing a dart at a dartboard and why the strategy at Metric Wealth is to select funds that keep costs low and your dollars spread across the whole index, rather than a handful of stocks selected by so called experts.

Investing in Bonds

We talk a lot about the main growth part of our portfolios – stocks and shares.

However, we do not spend much time looking at the ‘defensive’ section of the portfolios. Most of you will be in a 70/30 or 90/10 split in favour of growth v defensive.

So, I thought I would write a little this week on what makes up this piece of the puzzle.

The simplest potential component is plain old cash. With Australia’s previously higher interest rates, this was a nice place to earn a steady return of a couple of percent without too much worry. We now see this squeezed right down to near zero, so where do we head?

Most of the defensive component is now in bonds. But what exactly is a bond?

Bonds are used by large institutions (governments, banks and businesses) to loan and borrow money.

If we start with the premise of a term deposit, that we will be familiar with:

We give money to a bank, for a fixed term of months or years. In return the bank give us interest and return the deposit in full at the end of the term. This is known also as a Bond. While our money is with the bank, they will lend it on again via credit cards and mortgages at a higher rate than they pay us.

In a similar way, larger (non-banking) companies that need money for expansion may also offer bonds to other companies, banks, and investment funds. For example, if Coles wanted $50m to build a new store, they won’t head down to the local Westpac to take out a loan, it’ll be funded by these institutions lending money to them. These are known as Corporate Bonds.

If you are a big enough institution you can also lend money to the Government (via the Central Bank.) You’ll get a lower interest rate than lending to a Corporate (as there’s little chance of default – a central bank can print money to cover its liabilities.)

So how does this make us, as investors, any return?

The defensive section of your portfolio will be invested in bond funds which spread your money over 1,000s of different bonds, each with different issuers and terms – as with shares, diversification is key, as we never truly know what the future will hold.

We hold bonds in a portfolio, as they generally go up in value when the stock market falls.

As you can see in the graph, over the long-term bonds average less than stocks.

So why hold an asset that is likely to return less? There are three good reasons:

1) Stability – when stock markets fall, our defensive component can help us mentally cope and avoid withdrawing from the market by holding or increasing its value.

2) Time – when equities fall, it is a common strategy in retirement, to take regular pension payment from the defensive part of the portfolio, to give us time for the equities to recover.

3) Inflation protection – unlike cash, bonds have generally beaten inflation over time.

Equities are how we own a share of institutions and their future profits. Bonds are how we lend to institutions.

Bonds are an ‘emotional’ asset class. On their own they won’t provide most investors enough return to continually increase their portfolios ahead of inflation and withdrawals. They do help stop us running from equities during downturns, when it is most important to hold onto them.

If you are still some way from accessing your super, there is a good argument not to have any bonds in your portfolio. Some may choose never to hold them if they can mentally handle volatility. Full disclaimer, I don’t currently have them in my savings but I expect to build this in a little later in life.

As ever, if you have any questions, do let me know,

Investing: Game stopped

It’s been hard to escape the story of Gamestop, Reddit and a battle of Hedge Funds in the last couple of weeks.

For those of you that haven’t seen it (plus points from me for not reading the financial pages) - a little background.

Reddit is the world’s largest online message board. It has a variety of different forums where users can talk about anything from football to cookery. One such section is the ‘Wall Street Bets’ forum, where users share their own tips and experiences in trading shares.

As trading shares has become much easier due to new phone apps and lower broking costs, these forums have seen a steady rise over the last few years.

A user on this forum noticed something of interest about the shares in US retailer Gamestop. Gamestop is a video games retailer that you’d find in many shopping centres across the states.

As you’d imagine the profits of such a bricks and mortar store had fallen steadily in recent times, as more people switched to online shopping or directly downloading games for their systems. It’s share price had reflected this falling down to single dollar figures.

The user on Reddit had noticed something else though – a significant number of Hedge Funds held short positions against the stock.

What is a Short Position?

A short is basically a bet that a stock will fall. It’s the opposite of traditional investing where you hold a stock in the hope it rises and pays you a dividend over time (also known as a long position).

Hedge Funds are so named because they can hold short and long positions – hedging their bets if you will.

To create a short position, a Hedge Fund must borrow shares from a shareholder in Gamestop. In return for borrowing the shares they pay the original share holder a fee for doing so.

The Hedge Fund immediately sells the shares they’ve borrowed and hopes that when the original owners ask for their return (or they decide to return them), they can buy them back off the market at a reduced cost.

An example:

You own a coat worth $100. I borrow the coat from you and offer to pay you $1 for every month I borrow it for. I immediately sell the coat for $100.

In 6 months time, the coat is on sale at half price. I buy the coat for $50 and return it to you.

I’ve pocketed $50 less the $6 ‘borrowing fee’ for a nice profit of $46.

So what happened?

One Redditor notices that nearly 100% of all GME stock is tied up in short positions. So much so, that if the stock price were to rise, the Hedgefunds would be in a lot of trouble. He begins to buy GME shares and tells the Wall Street Bet’s message board – one by one they begin buying shares and soon hundreds of users are jumping on. The price of GME shares starts to rise.

As early investors start showing screenshots of very healthy balances, other users fearing they will miss out, join in.

What do we know about share prices?

1. There are only a limited number of stocks available to buy in any one company.

2. When demand rises, prices rise (for there must always be a seller willing to sell at the price you’re willing to pay).

Pretty soon, anyone who had lent their shares to a Hedge Fund started asking for them back. The Hedge Funds are having to pay ridiculous money for a stock in a failing company, that has now risen from $18 on the 1st of January to $483 per share on the 27th of January.

Then the switch was flipped: Two of the biggest online brokers in the US – Robin Hood and WeBull both suspended the purchase of GME shares citing ‘extreme volatility’ meaning they had a duty to protect investors - a clause normally only enacted for major catastrophes.

It was a move roundly panned by both sides of the American Congress but it did act as a circuit breaker. Hedge Funds could correct their positions and many traders got cold feet and sold out.

The problem with any move of a herd is that the last ones in are left holding the bag. With more sellers than buyers, the price went down as quickly as it rose.

Those who bought in at over $300 per share sit today with 80% loses – given where the interest started many are likely to be young or inexperienced traders.

What can we learn from the fall out?

Day trading is the exact opposite of what we should strive to do with our family’s money. It’s concentrated on a small number of stocks and short time period and to an extent (when going well) it’s exciting!

Long-term investing is a comparatively boring pursuit involving long period of time where to achieve the best results, we must fight the urge to make changes and do something different to our plan.

Hedge Funds will continue to exist but offer very little value over the long-term strategies we use at Metric Wealth. The recent COVID downturn in the markets should have been the ideal environment for them to show their skills and make money while stock fell. However, they failed to do so.

Short selling continues to be a legal practice but to my mind, making money out of a companies’ misfortune doesn’t sit morally well with me. I’ll continue to avoid funds that do so.

Above all it should remind us that investing isn’t a game – new apps like Robin Hood are like using a pokie machine – confetti cascades down when you make your first trade. The Australian SelfWealth trading app, here in Australia tells you how much your shares have gone up or down in one day as soon as you open it, prompting you to trade. It compares your returns in one day to other investors like a leader board.

Leader boards aren’t important, how far you’ve progressed is.

Behavioural Economics: Doing the Gruen

When making our future financial plans, the best investment plan can go to pieces if our expenditure gets out of control.

Whilst we know general inflation is largely unavoidable (hence we plan for it in our projections) it can still be hard not to overspend, particularly when every major retailer employs teams of people to make spending easier.

This came to mind recently while I was talking to a friend about the ABC show Gruen, which looks at the world of advertising. The show is named after the architect Victor Gruen, who designed shopping malls and stores in a deliberately confusing way, so that shoppers will forget their intentions and make impulse purchases.

If you’ve ever been to an Ikea to buy one item, you’ll know how hard it is to get in and out quickly.

Similarly, supermarkets will layout their stores so that ‘essentials’ like milk and eggs at the back of the store, hoping that you’ll pick up other items on the way.

Have a look at this list of different psychological techniques that are used in advertising on the Visual Capitalist website

Many of these will be familiar, but there’s perhaps a few there that you didn’t know.

By being aware of them, you’ll find you can spot them more easily in day-to-day transactions.

Of course, some techniques Financial Planners are prone to use too – helping someone to clear a credit card or set up a regular investment plan by visualising it as ‘the cost of a coffee per day’ is generally more effective than saying $100 a month or $1,200 a year!

Predictions are a fools game

Welcome to 2021.

Hopefully, a year where we can return to some sort of normality but equally several question marks remain.

It is the time of year where newspapers and tv press are wheeling out experts to give their financial predictions for the year ahead.

How many of these experts were right in 2020? I am willing to guess its between zero and none. Short term market predictions and stories remain disposable page fillers.

A look back over the top 20 stocks on the Australian Share market makes for interesting reading and reiterates some important lessons.

Firstly: If I had sat you down on January 1st 2020 and described what would happen in the following year – bushfires continuing, a global shutdown of the economy, empty sports stadiums – would you expect any of the above to be Green, let alone 12 out of the 20?

Overall, the ASX300 made a total return (including dividends) of +1.73%. Global stocks made even more.

Secondly, could anyone pick the winners from that list even if we had a ‘normal’ year?

Highly unlikely and if we could find such an expert, why would they share their secrets and run an investment fund for us? As the amount of information available to the markets and investors has grown over the last 20 or 30 years, with company accounts freely available online, tighter regulation on insider knowledge and trading, the days of a stock picker getting an edge have gone.

Therefore, we continue to structure your valuable family wealth to gain their exposure to each share market across the globe via low cost index funds. These funds purchase every share on the market in proportion, rather than speculating on a small selection.

It’s cheaper, more diversified and has been shown to beat the majority of the competition.

It is our behavior as investors, that will continue to be the biggest influence on your returns. Each of you has shown by not panicking in 2020, you can do this.

Cash: Alternatives and options

Earlier this month we saw the final nail in the coffin of cash returns, with the Reserve Bank of Australia (RBA) reducing the nations interest rate to just 0.1%.

A quick look on comparison sites and you will see the number of saving accounts offering over 1% reducing daily and those that do offer a higher rate probably only do so for a few months on a ‘welcome’ rate.

We always bear in mind inflation when discussing cash – inflation being how much our day to day costs are rising. You’ve probably heard me talk about ‘Real Returns.’ If I hold a bank account earning 1% interest but the typical goods I’d spend it on have gone up 2%, my real return is -1% per year.

Inflation over the last ten years in Australia has averaged 2.1% per year with the average Cash investment being 2.7% over the same period, so your typical cash investor might have scraped a 0.6% real return. And then paid tax on it.

The next ten years could well look very different – the RBA have already said that the base rate is unlikely to rise for at least 3 years.

Now whilst I am loathed to make predictions, I would not be surprised to see inflation start to rise for a number of reasons.

Remember than magic money tree the Government found to pay Jobkeeper?

Well that has left a big black hole in the country’s wallet to the tune of over $100bn.

The easiest way for the real value of that debt to fall is for inflation to rise – if wages, property and the cost of a loaf of bread creep up, the Government makes more in income, property and sales tax.

By using their tools to increase inflation, rather than simply apply higher taxes, the mental pain to the taxpayer is diluted.

‘Hey, a loaf of bread is 50c more!’

‘Never mind that, you won’t believe what our house is valued at!’

Secondly, as a collective if we’re not earning much on our savings, we’re more likely to spend.

The incentive for your average saver just isn’t there compared to the gratification of purchasing. This will have a push upwards on prices.

These things considered, cash savers could see negative real returns for some time.

What are our alternatives to cash saving? There are few things that offer the single major benefit of cash, which is a lack of volatility but consider:

- Using an offset account if you have a mortgage. Your effective interest rate becomes the rate paid on your mortgage.

- Paying down debts or mortgages, either in full or at a faster rate.

- Gift money now you had set aside for later – for children, grandchildren etc. It’s better they spend $100 now than $100 in 5 years’ time when it’s spending power might be 10% less.

- Consider an investment account with a lower risk profile than your Super is invested at. Some potential downside with this option but should still beat cash over the medium to longer term.

Above all, our golden rule will always be to only keep as much cash as allows you to sleep easily at night.

Politics & Stockmarkets: Red House, Blue House, White House

As I am sure you’ve all been watching, we’ve recently seen the end (for now) of one of the most drawn out and painful voting processes in recent times.

Yes, Frazer and Pete won Elly and Becky Miles' hearts on The Bachelorette.

But in international news, baring many legal challenges, we will see Joe Biden taking up residence in 1600 Pennsylvania Avenue, Washington in January.

In most meetings I have had this week, people have asked about the impact of this on portfolios especially seeing a little jump in US and Aus stocks this week.

Markets in most countries like stability, so many times we have seen a small rally in stocks after a campaign is over, regardless of the outcome. Biden was long predicted to win this one (albeit more handsomely as he ultimately did) so there is no great shock here. And with the country roughly split Republican and Democrat, any new president knows he must sit somewhere in the middle of left and right.

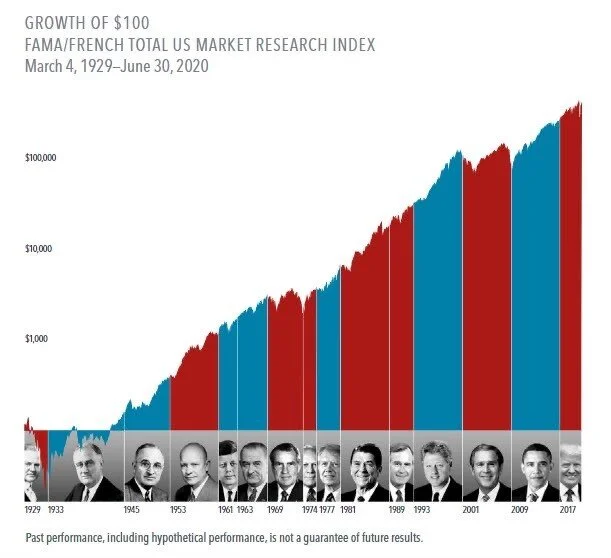

I’ve taken the below from an article by Dimensional Fund Managers to show the bigger picture.

Regardless of political party, the stock market marches on. In fact, the small rallies this week are more likely to come from the successful results in vaccination production giving renewed optimism to a global reopening in 2021.

Whatever your feelings on America, there will be a reasonable amount of your portfolios directed there – the total market value of Apple, for example is US$2 trillion.

The total value of all 300 companies on Australia’s ASX 300? US$1.3 trillion.

Hence our portfolios should always be globally focused unlike some investors who hold only Australian stocks because of the franking credits.

More negative writers suggest the US market is higher risk due to its bigger players: Facebook, Apple, Google, Netflix & Amazon being new Technology firms.

But it’s worth remembering that every company would have been classed as new technology at some point in the past – cars, railroads, electricity companies were all technology companies once upon a time!