Investing: A Golden Dart

A story last week from the UK. One of the largest newspapers, The Daily Telegraph (different to the Murdoch publication in Australian) runs a regular ‘Fantasy Fund Manager’ competition in it’s finance section.

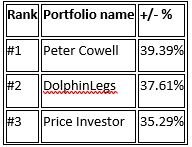

Entrants are given £100,000 of virtual money and 3 months to pick and trade funds and shares to build the biggest pot. The winner receives £10,000 and at the end of February the winners were announced:

Leaderboard

The winner Peter Cowell, told his story to the Telegraph of research at 5am before the markets opened, while he tended to his baby daughter and an all or nothing punt on the shares of a cinema chain ahead of a Covid reopening announcement. Exciting stuff.

The Telegraph followed up their story be speaking to the anonymous investor ‘DolphinLegs’ who came second.

He had, unfortunately spent the last three months in hospital and had forgotten he’d even entered the competition.

Moreover, ‘DolphinLegs’ picked stocks at random, rather than carefully devising a five-stock strategy which would weather all market conditions and make a mockery of fund managers trading every day to outwit the competition.

“I spent literally no time assessing the merits of the listed stocks, using my preferred ‘golden dart’ technique. This involves the throwing of a virtual dart at a virtual dart board and bingo, five stocks had been selected within a matter of seconds,” they said.

Proof if ever were needed, that expensive fund managers know little more than throwing a dart at a dartboard and why the strategy at Metric Wealth is to select funds that keep costs low and your dollars spread across the whole index, rather than a handful of stocks selected by so called experts.