Investing: Game stopped

It’s been hard to escape the story of Gamestop, Reddit and a battle of Hedge Funds in the last couple of weeks.

For those of you that haven’t seen it (plus points from me for not reading the financial pages) - a little background.

Reddit is the world’s largest online message board. It has a variety of different forums where users can talk about anything from football to cookery. One such section is the ‘Wall Street Bets’ forum, where users share their own tips and experiences in trading shares.

As trading shares has become much easier due to new phone apps and lower broking costs, these forums have seen a steady rise over the last few years.

A user on this forum noticed something of interest about the shares in US retailer Gamestop. Gamestop is a video games retailer that you’d find in many shopping centres across the states.

As you’d imagine the profits of such a bricks and mortar store had fallen steadily in recent times, as more people switched to online shopping or directly downloading games for their systems. It’s share price had reflected this falling down to single dollar figures.

The user on Reddit had noticed something else though – a significant number of Hedge Funds held short positions against the stock.

What is a Short Position?

A short is basically a bet that a stock will fall. It’s the opposite of traditional investing where you hold a stock in the hope it rises and pays you a dividend over time (also known as a long position).

Hedge Funds are so named because they can hold short and long positions – hedging their bets if you will.

To create a short position, a Hedge Fund must borrow shares from a shareholder in Gamestop. In return for borrowing the shares they pay the original share holder a fee for doing so.

The Hedge Fund immediately sells the shares they’ve borrowed and hopes that when the original owners ask for their return (or they decide to return them), they can buy them back off the market at a reduced cost.

An example:

You own a coat worth $100. I borrow the coat from you and offer to pay you $1 for every month I borrow it for. I immediately sell the coat for $100.

In 6 months time, the coat is on sale at half price. I buy the coat for $50 and return it to you.

I’ve pocketed $50 less the $6 ‘borrowing fee’ for a nice profit of $46.

So what happened?

One Redditor notices that nearly 100% of all GME stock is tied up in short positions. So much so, that if the stock price were to rise, the Hedgefunds would be in a lot of trouble. He begins to buy GME shares and tells the Wall Street Bet’s message board – one by one they begin buying shares and soon hundreds of users are jumping on. The price of GME shares starts to rise.

As early investors start showing screenshots of very healthy balances, other users fearing they will miss out, join in.

What do we know about share prices?

1. There are only a limited number of stocks available to buy in any one company.

2. When demand rises, prices rise (for there must always be a seller willing to sell at the price you’re willing to pay).

Pretty soon, anyone who had lent their shares to a Hedge Fund started asking for them back. The Hedge Funds are having to pay ridiculous money for a stock in a failing company, that has now risen from $18 on the 1st of January to $483 per share on the 27th of January.

Then the switch was flipped: Two of the biggest online brokers in the US – Robin Hood and WeBull both suspended the purchase of GME shares citing ‘extreme volatility’ meaning they had a duty to protect investors - a clause normally only enacted for major catastrophes.

It was a move roundly panned by both sides of the American Congress but it did act as a circuit breaker. Hedge Funds could correct their positions and many traders got cold feet and sold out.

The problem with any move of a herd is that the last ones in are left holding the bag. With more sellers than buyers, the price went down as quickly as it rose.

Those who bought in at over $300 per share sit today with 80% loses – given where the interest started many are likely to be young or inexperienced traders.

What can we learn from the fall out?

Day trading is the exact opposite of what we should strive to do with our family’s money. It’s concentrated on a small number of stocks and short time period and to an extent (when going well) it’s exciting!

Long-term investing is a comparatively boring pursuit involving long period of time where to achieve the best results, we must fight the urge to make changes and do something different to our plan.

Hedge Funds will continue to exist but offer very little value over the long-term strategies we use at Metric Wealth. The recent COVID downturn in the markets should have been the ideal environment for them to show their skills and make money while stock fell. However, they failed to do so.

Short selling continues to be a legal practice but to my mind, making money out of a companies’ misfortune doesn’t sit morally well with me. I’ll continue to avoid funds that do so.

Above all it should remind us that investing isn’t a game – new apps like Robin Hood are like using a pokie machine – confetti cascades down when you make your first trade. The Australian SelfWealth trading app, here in Australia tells you how much your shares have gone up or down in one day as soon as you open it, prompting you to trade. It compares your returns in one day to other investors like a leader board.

Leader boards aren’t important, how far you’ve progressed is.

Behavioural Economics: Doing the Gruen

When making our future financial plans, the best investment plan can go to pieces if our expenditure gets out of control.

Whilst we know general inflation is largely unavoidable (hence we plan for it in our projections) it can still be hard not to overspend, particularly when every major retailer employs teams of people to make spending easier.

This came to mind recently while I was talking to a friend about the ABC show Gruen, which looks at the world of advertising. The show is named after the architect Victor Gruen, who designed shopping malls and stores in a deliberately confusing way, so that shoppers will forget their intentions and make impulse purchases.

If you’ve ever been to an Ikea to buy one item, you’ll know how hard it is to get in and out quickly.

Similarly, supermarkets will layout their stores so that ‘essentials’ like milk and eggs at the back of the store, hoping that you’ll pick up other items on the way.

Have a look at this list of different psychological techniques that are used in advertising on the Visual Capitalist website

Many of these will be familiar, but there’s perhaps a few there that you didn’t know.

By being aware of them, you’ll find you can spot them more easily in day-to-day transactions.

Of course, some techniques Financial Planners are prone to use too – helping someone to clear a credit card or set up a regular investment plan by visualising it as ‘the cost of a coffee per day’ is generally more effective than saying $100 a month or $1,200 a year!

Predictions are a fools game

Welcome to 2021.

Hopefully, a year where we can return to some sort of normality but equally several question marks remain.

It is the time of year where newspapers and tv press are wheeling out experts to give their financial predictions for the year ahead.

How many of these experts were right in 2020? I am willing to guess its between zero and none. Short term market predictions and stories remain disposable page fillers.

A look back over the top 20 stocks on the Australian Share market makes for interesting reading and reiterates some important lessons.

Firstly: If I had sat you down on January 1st 2020 and described what would happen in the following year – bushfires continuing, a global shutdown of the economy, empty sports stadiums – would you expect any of the above to be Green, let alone 12 out of the 20?

Overall, the ASX300 made a total return (including dividends) of +1.73%. Global stocks made even more.

Secondly, could anyone pick the winners from that list even if we had a ‘normal’ year?

Highly unlikely and if we could find such an expert, why would they share their secrets and run an investment fund for us? As the amount of information available to the markets and investors has grown over the last 20 or 30 years, with company accounts freely available online, tighter regulation on insider knowledge and trading, the days of a stock picker getting an edge have gone.

Therefore, we continue to structure your valuable family wealth to gain their exposure to each share market across the globe via low cost index funds. These funds purchase every share on the market in proportion, rather than speculating on a small selection.

It’s cheaper, more diversified and has been shown to beat the majority of the competition.

It is our behavior as investors, that will continue to be the biggest influence on your returns. Each of you has shown by not panicking in 2020, you can do this.

Cash: Alternatives and options

Earlier this month we saw the final nail in the coffin of cash returns, with the Reserve Bank of Australia (RBA) reducing the nations interest rate to just 0.1%.

A quick look on comparison sites and you will see the number of saving accounts offering over 1% reducing daily and those that do offer a higher rate probably only do so for a few months on a ‘welcome’ rate.

We always bear in mind inflation when discussing cash – inflation being how much our day to day costs are rising. You’ve probably heard me talk about ‘Real Returns.’ If I hold a bank account earning 1% interest but the typical goods I’d spend it on have gone up 2%, my real return is -1% per year.

Inflation over the last ten years in Australia has averaged 2.1% per year with the average Cash investment being 2.7% over the same period, so your typical cash investor might have scraped a 0.6% real return. And then paid tax on it.

The next ten years could well look very different – the RBA have already said that the base rate is unlikely to rise for at least 3 years.

Now whilst I am loathed to make predictions, I would not be surprised to see inflation start to rise for a number of reasons.

Remember than magic money tree the Government found to pay Jobkeeper?

Well that has left a big black hole in the country’s wallet to the tune of over $100bn.

The easiest way for the real value of that debt to fall is for inflation to rise – if wages, property and the cost of a loaf of bread creep up, the Government makes more in income, property and sales tax.

By using their tools to increase inflation, rather than simply apply higher taxes, the mental pain to the taxpayer is diluted.

‘Hey, a loaf of bread is 50c more!’

‘Never mind that, you won’t believe what our house is valued at!’

Secondly, as a collective if we’re not earning much on our savings, we’re more likely to spend.

The incentive for your average saver just isn’t there compared to the gratification of purchasing. This will have a push upwards on prices.

These things considered, cash savers could see negative real returns for some time.

What are our alternatives to cash saving? There are few things that offer the single major benefit of cash, which is a lack of volatility but consider:

- Using an offset account if you have a mortgage. Your effective interest rate becomes the rate paid on your mortgage.

- Paying down debts or mortgages, either in full or at a faster rate.

- Gift money now you had set aside for later – for children, grandchildren etc. It’s better they spend $100 now than $100 in 5 years’ time when it’s spending power might be 10% less.

- Consider an investment account with a lower risk profile than your Super is invested at. Some potential downside with this option but should still beat cash over the medium to longer term.

Above all, our golden rule will always be to only keep as much cash as allows you to sleep easily at night.

Politics & Stockmarkets: Red House, Blue House, White House

As I am sure you’ve all been watching, we’ve recently seen the end (for now) of one of the most drawn out and painful voting processes in recent times.

Yes, Frazer and Pete won Elly and Becky Miles' hearts on The Bachelorette.

But in international news, baring many legal challenges, we will see Joe Biden taking up residence in 1600 Pennsylvania Avenue, Washington in January.

In most meetings I have had this week, people have asked about the impact of this on portfolios especially seeing a little jump in US and Aus stocks this week.

Markets in most countries like stability, so many times we have seen a small rally in stocks after a campaign is over, regardless of the outcome. Biden was long predicted to win this one (albeit more handsomely as he ultimately did) so there is no great shock here. And with the country roughly split Republican and Democrat, any new president knows he must sit somewhere in the middle of left and right.

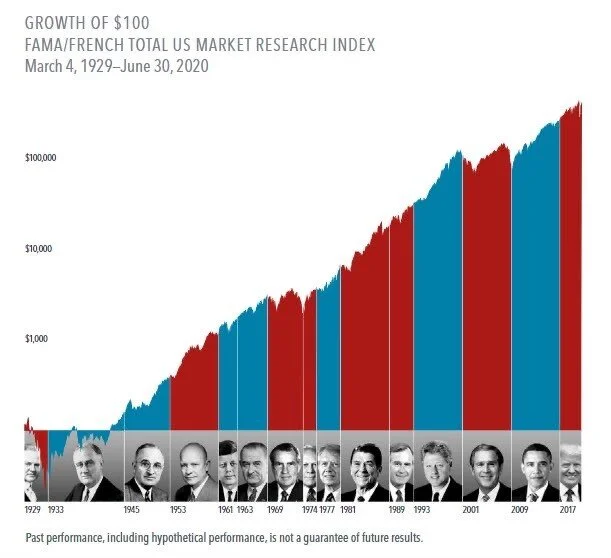

I’ve taken the below from an article by Dimensional Fund Managers to show the bigger picture.

Regardless of political party, the stock market marches on. In fact, the small rallies this week are more likely to come from the successful results in vaccination production giving renewed optimism to a global reopening in 2021.

Whatever your feelings on America, there will be a reasonable amount of your portfolios directed there – the total market value of Apple, for example is US$2 trillion.

The total value of all 300 companies on Australia’s ASX 300? US$1.3 trillion.

Hence our portfolios should always be globally focused unlike some investors who hold only Australian stocks because of the franking credits.

More negative writers suggest the US market is higher risk due to its bigger players: Facebook, Apple, Google, Netflix & Amazon being new Technology firms.

But it’s worth remembering that every company would have been classed as new technology at some point in the past – cars, railroads, electricity companies were all technology companies once upon a time!

Economics and Toilet Roll

As another week passes, I just wanted to send on another quick update to you all as so much seems to be going on.

This week, we’ve seen the start of Government intervention to help stimulate the economies through the next year as the virus is managed. Australia were one of the first Government’s to lower the Base interest rate and were follow by major economies worldwide.

The US seeing gains of around 5% on two different days this week, as a major cut was announced.

On a broad level, the most reported impact of a reduction in interest rates, is to reduce the monthly payments of those people with mortgages, leaving them greater capital to spend within the economy. To those with savings in cash the returns get more pitiful and are further eroded by inflation. Does this change the human psychology to one’s cash savings? Certainly, we all feel less guilt in spending cash if ‘it’s not earning much anyway’ than when we receive better compensation for it being with the bank.

On a larger scale though, it helps businesses continue to stick to their own plans – any company that looks to upscale will need debt at some point to buy offices, import raw materials etc. so it helps keep that flow of money going, and to continue expansion.

Indeed, the stock market globally should always be considered a measure of human ingenuity – one of the main reason stock markets have always risen over the long term is that obsolete companies die and are regularly being replaced by innovators and disruptors who have all sorts of growth ahead of them. The global stock market has on average advanced (gone up) 75% of the time and declined 25% of the time, with major downturns (down turns of 20%+) happening on average every 5 years.

In return for the backing of investors who buy their stocks, the business owners must return either stock price growth or a share of profits (dividends) to their backers or they will fail.

The Negative Events World Service (NEWS) only ever report on the level of the stock market (and love reporting on ‘billions’ wiped off) and never consider the impact of dividends to investor growth. Although a dividend is never guaranteed, they continued to be paid by most major companies even during the GFC.

Any dividends you receive currently in your Supers and Portfolios are either being reinvested into buying the great companies of the world at a short-term discount or being used to help pay your regular pension payments.

Compounding is the 8th wonder of the world as Einstein said.

Stock markets will continue to provide the main engine of all your portfolios and we will get through this short-term volatility. I invest my own family’s savings in the same portfolios you use and feel the same trepidation sometimes when I open my online account.

Speaking of which, to end on some positive news, one of my clients this week joked that we ‘should be buying shares in Kimberly Clark’ following the weeks run (probably the wrong word) on Toilet Roll.

So out of curiosity, I looked it up – Kimberly Clark’s shares are indeed flying up nearly 9% in 5 days and 5% on Wednesday alone.

Every single one of you will own shares in this company via the International shares portion of your portfolios, as we spread your investments across the whole of the US stock market.

Each person you’ll see on the news with trolleys stacked high with Toilet Roll will be putting dollars indirectly into your pockets. Sit back, wash your hands and leave them to it.

Covid Spooks Markets

My email on Monday had no inside knowledge I can assure you but this week the market volatility I anticipated happened. As we stand on Friday, the Australian stock market is down 7% and the US 10% as fears on Coronavirus spook traders.

Undoubtedly, this may cause you (and anyone I talk to) some anxiety – you wouldn’t be human if you did not feel this.

My comments on sticking to your own plans remain my advice – this is how markets work and it is exactly in episodes like these that inexperienced investors can ruin a lifetime of meticulous savings by seeking the placebo of moving to cash. To do so will mean they miss out on the inevitable rise when a vaccine is confirmed as effective.

Indeed, this is literally the reason you have chosen to employ me: to help ensure you make rational long-term decisions in periods of economic and / or market stress.

If I may suggest it, turn off the next news report, log out of your online account and enjoy your weekend. If you want to talk about any of the points, I am available for a call at any time.